Warehouse

Deadline

July 10, 2026

Judging

Date

July 27, 2026

Winners

Announced

August 12, 2026

Two major wine industry banks released reports this year. The standard annual SVB report is legendary. This is BMO’s first entry into the “wine report” landscape. We look at the two side-by-side. How do they differ and where do they converge?

The U.S. wine industry, valued at over $107 billion, continues to navigate a complex landscape shaped by evolving consumer preferences, economic pressures, and post-pandemic market adjustments. Two significant reports released in 2024 by BMO and Silicon Valley Bank (SVB) offer a comprehensive analysis of these dynamics, providing crucial insights for the on-trade sector and wine distributors/importers. Despite being published just a few months apart, these reports present both converging and diverging perspectives on the state of the wine industry, with actionable takeaways for industry stakeholders.

Premiumization and Stable Retail Sales: Both BMO and SVB underscore the stability and anticipated growth of premium wine sales. Wines priced above $10 per 750ml bottle have remained resilient, with both reports projecting continued growth through the end of 2024 and into the following year. This trend indicates a sustained consumer interest in higher-quality wines, even as the broader market faces challenges.

Shift Towards Direct Sales: A significant overlap in the findings of both reports is the emphasis on direct-to-consumer (DTC) sales channels. The SVB report highlights a decline in direct-to-consumer volume and value sales in 2023, alongside a drop in tasting room visitation for the second consecutive year. However, it also notes that strong holiday sales could improve the outlook. Similarly, BMO’s report reveals that direct sales through winery tasting rooms and wine clubs are a crucial revenue source for smaller wineries, which plan to expand this business. Larger wineries also intend to increase their direct sales efforts, recognizing the importance of building a direct relationship with consumers.

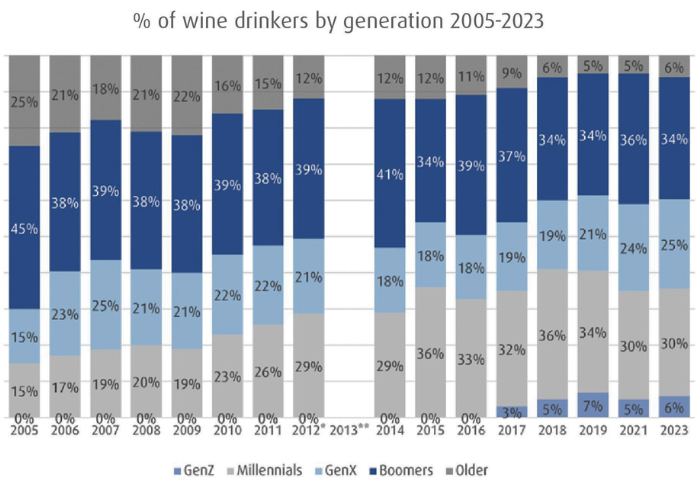

Demographic Shifts: Both reports highlight significant demographic changes among wine consumers. According to BMO, Millennials, Gen Z, and Gen X now comprise 61% of all wine drinkers, marking a shift from the traditionally dominant Baby Boomer segment. SVB also notes the trend of younger consumers increasingly choosing alternatives such as ready-to-drink (RTD) beverages, spirits, and cannabis. BMO says, “Research by WMC found that Gen Z and Millennial wine consumers exhibit a higher rate of believing that alcohol is not part of a healthy lifestyle or diet. However, the greatest increase in rates of abstention from alcohol since 2019 has been seen in consumers aged 60 and older.”

Image: % of wine drinkers by generation; source: BMO report

This demographic shift presents both challenges and opportunities for the wine industry, necessitating targeted marketing strategies to engage younger consumers. BMO offers interesting insights into the core demographic:

Core wine drinkers — defined by the WMC as enjoying wine at least once a week or more — are the key drivers of demand. An increasing share of these drinkers are also defined as “high-end” consumers who spend $20 per 750ml at least once a month. Core wine drinkers accounted for 58% of all wine drinkers in 2023. While that share has increased in recent years, it’s primarily from the decline in marginal wine drinkers rather than growing numbers of core wine drinkers.

Wine drinkers are more affluent than the total LDA population, with 53% of wine drinkers earning more than $100,000 a year compared to just 34% of non-wine drinkers, according to the WMC. Fifty-two percent of wine drinkers have a college degree and 71% own a home.

Challenges from Inventory Normalization: SVB discusses the issue of an oversupply of planted vineyards leading to potential inventory excess, discounting, and price reductions. This aligns with BMO’s observation that market destocking has been a significant factor in recent market volume declines. As inventories normalize, the market is expected to revert to pre-pandemic levels, offering a more stable environment for wineries.

Market Optimism: BMO's report is notably more optimistic than SVB’s in its outlook for revenue growth. While SVB highlights the need for increased efficiencies in production, grape growing, and marketing due to a slowing demand environment, BMO reports that 71% of U.S. wineries forecast revenue growth in 2024. This optimism is fueled by expectations of market stabilization and the potential for growth, particularly among premium wineries.

In addition, the BMO report notes: “Wine-based RTDs, sparkling wine in innovative packaging and bold, flavor-forward winemaking and marketing have performed better than wine overall and could continue to spur trial by all consumers in the near-term.”

Impact on On-Trade and Wine Distributors/Importers: SVB’s report notes a decline in on-trade sales, with direct-to-consumer channels becoming increasingly important. It mentions that sales to restaurants have dropped significantly over the past decade, driven by restaurant owners’ reluctance to stock expensive wines and increasing markups on wine by the glass.

Conversely, BMO emphasizes the role of product innovation and increased on-premise and direct-to-consumer sales as key growth drivers. Regarding the on-trade, some of the BMO report conclusions are worth quoting at length:

While transformed by the pandemic, the on-premise sector offers another route to directly engage with consumers while also expanding the profile of one’s brand regionally and nationwide. The ongoing strength of cocktails in this sector could be an opening for wine-based mixed drinks. More affordable by-the-glass options facilitated by new packaging formats could serve existing wine drinkers and entice new ones. A consolidated and competitive national retail market will make it harder to support sales growth for wineries in the challenging middle tier of producing more than 50,000 cases, yet that amount of production could well serve a strategic shift to expand on-premise distribution and new DTC markets.

Compare that positive outlook with the conclusions this year from Silicon Valley Bank:

Unlike 20 years ago when the wine list was a large book, consumers today get a one-page beverage list and pair spirits, cocktails, beer, cross-over beverages, and even non-alcoholic options with their meals. Restaurant owners are more selective about carrying large stocks of expensive bottles of wine and may be reluctant to buy any wine that doesn’t yield a near-term return. According to NielsenIQ, a serving of wine in a restaurant is more than twice as expensive as spirits. Restaurateur markups continue to increase, decreasing the value of wine by the glass. That’s not the best formula to stimulate wine demand in restaurants.

BMO suggests that while the traditional on-trade channel faces challenges, there are opportunities for wineries that can innovate and adapt to changing consumer preferences. SVB is gloomy about the on-trade, particularly given shifting restaurant practices. In many ways, they are two sides of the same coin.

Adapt to Changing Consumer Preferences: Both reports indicate a need for the on-trade sector to adapt to evolving consumer preferences. With younger consumers showing a preference for a diverse range of beverages, including spirits, RTDs, and non-alcoholic options, restaurants and bars should consider diversifying their beverage menus. This could involve offering a curated selection of premium wines, emphasizing quality and unique experiences over volume.

Focus on Premium Offerings: The premiumization trend offers a clear path forward for the on-trade sector. By focusing on higher-priced, high-quality wines, restaurants and bars can appeal to the more affluent and discerning segment of wine consumers. This approach can help offset the decline in overall wine consumption and leverage the stable demand for premium products.

Leverage Direct Sales Opportunities: Wineries increasingly prioritize direct sales through tasting rooms and wine clubs. Restaurants and bars can capitalize on this trend by partnering with wineries to offer exclusive wines or hosting winery events and tastings. These collaborations can enhance the customer experience and drive sales through unique, memorable interactions.

Image Source: WineNews

Manage Inventory Efficiently: The issue of inventory excess and the need for normalization highlighted by both reports underscores the importance of efficient inventory management. Distributors and importers should work closely with wineries to ensure a balanced supply chain, avoiding overstocking and minimizing the need for discounting.

Embrace Innovation: Innovation in product offerings and marketing strategies is crucial for staying competitive. BMO’s report highlights the role of continued product innovation as a key growth driver. Distributors and importers should seek out innovative wines and brands that cater to the evolving tastes of younger consumers, including those that emphasize sustainability, unique varietals, and storytelling.

Strengthen Direct-to-Consumer Channels: With direct-to-consumer sales becoming increasingly important, distributors and importers should explore ways to support and enhance these channels. This could involve offering logistical support for direct shipments, collaborating on marketing campaigns, or providing value-added services such as virtual tastings and educational content.

Consumer Trust: Competitions provide a seal of approval that can build consumer trust. For newer wineries or those entering new markets, awards can serve as a powerful marketing tool to establish credibility and attract new customers. This is particularly important given the demographic shifts highlighted in the BMO report, where younger consumers are becoming a larger portion of the wine market.

Influencing Wine Purchase Decisions: Awards and accolades can significantly influence consumer purchasing decisions. In retail settings, a bottle adorned with medals or high ratings is more likely to catch a consumer’s eye and be chosen over competitors. This is crucial in an environment where consumers are increasingly selective, as mentioned in the SVB report. With the normalization of inventory levels and a focus on quality, having award-winning wines can help wineries stand out on the shelf.

Supporting Direct-to-Consumer Sales: Given the emphasis on direct-to-consumer channels in both the BMO and SVB reports, competition can be particularly beneficial. Awards can enhance the appeal of wines sold directly through tasting rooms or wine clubs. For instance, promoting award-winning wines in a tasting room can lead to higher sales and stronger wine club memberships. These accolades can be highlighted in marketing materials, on websites, and through social media campaigns to drive traffic and conversions.

[[relatedPurchasesItems-55]]

The 2024 reports from BMO and Silicon Valley Bank provide a nuanced view of the U.S. wine industry, highlighting both challenges and opportunities. The convergence in their emphasis on premiumization, direct sales, and demographic shifts offers a clear direction for industry stakeholders. However, the diverging perspectives on market optimism and the impact on the on-trade sector call for a strategic approach tailored to individual business contexts. Businesses should examine their own actual conditions vis-à-vis the two perspectives from very powerful and insightful wine divisions.

For the on-trade sector, adapting to changing consumer preferences and focusing on premium offerings will be crucial. Wine distributors and importers, meanwhile, should prioritize efficient inventory management, embrace innovation, and strengthen direct-to-consumer channels. By leveraging these insights, the U.S. wine industry can navigate its current challenges and capitalize on emerging opportunities for growth and stabilization.

Header Image Source: Shutterstock

Grow your wines in the off-premise channels of the USA. The Early Bird submission deadline is February 20, 2026, and the domestic submission deadline is June 30, 2026. Here is how to enter.